Extract from Flipping Out

“If your business depends on you, you don’t own a business, you have a job. And it’s the worst job in the world because you’re working for a lunatic!”

– Michael E Gerber

Business owners are crazy. The risk is enormous, we live in uncertain times with an economy and government that makes it difficult for businesses to succeed, financing has become increasingly more difficult, competition is everywhere, and the multinationals have an unfair advantage in scaling their businesses.

As business owners, we put everything on the line.

Despite the deck being stacked against them, entrepreneurs create new businesses every day.

So, what makes a business owner successful?

“It’s about having a system and processes for making business easier and less dependent on the Business Owner.”

– Doug Downer

Success is in the eye of the entrepreneur who makes the decision to leave the safety and sanity of paid employment to become self-employed.

“Every Business Owner is Self-Employed but not every Self-Employed person is a Business Owner.”

– Doug Downer

What Is the Difference between self-employed and business owner?

Time and Money

Self-employed don’t have the luxury of time like the established business owner.

The self-employed entrepreneur is essentially exchanging time for money, and if they’re not working, they’re not making money. So, they tend to keep themselves busy as often as possible and their focus is on immediate income.

The self-employed entrepreneur typically doesn’t have any employees, so they end up doing everything themselves: marketing, accounts, tax, sales, and administration. Often, their passion is the technical aspects of their venture.

These tasks take them away from their core, and in most cases their productivity is not as good as a dedicated professional in that space. A good entrepreneur will outsource these functions, enabling them to focus on their core expertise and often what they enjoy.

The business owner is more concerned with lifestyle and work/life integration, wealth creation, and building an asset, because the business has employed individuals to help the business grow.

I would like to reiterate the misnomer that going into business will somehow give the business owner a better quality of life. It will eventually, but it will take some time. Be prepared to work hard and put systems in place to remove the dependence on the owner.

Day to Day vs Strategic thinking

The self-employed works in the business, while the business owner works on it.

The self-employed are responsible for all the income generating activities, and they apply their trade and the technical aspects of their skillset and passion. They are the technician.

The established business owner is focused on the strategic activities and building an enterprise that has structure, systems, and processes, so it can be scaled to grow and work without them.

Michael Gerber immortalised the concept in his book The E-Myth, detailing the technician starting a business without the requisite skills to grow a business. They have this propensity to remain a technician working in the business doing the-day to-day, rather than strategically thinking and acting in a way that has them focus on the business.

Autopilot

One of the ways that owners have learnt to build a business, is to make it run on autopilot. This means that they are poised to create processes and systems that would help the business run irrespective of whether the business owner was present or not. This might not be the same case with the self-employed, as an absence in the field of business may cause a plummet in sales.

The Role of the Business Owner

A business owner focuses on building both tangible and intangibles assets, by developing goodwill in their business and brand.

The primary focus for many self-employed people is selling their time and skills. Business owners are looking for much more than a wage: they are seeking a return on their investment commensurate with the capital, skill, and time they have invested in it.

There is no right or wrong when it comes to deciding whether to be a business owner or simply self-employed.

Either way, both can prepare their operations to mirror that of a franchise operation that will deliver systems and processes, and improved operations, sales, and profitability.

Why Someone Should Consider Being a Franchisor

There are several reasons why a business owner should consider becoming a franchisor.

Reliable Customer Experience

The success of so many businesses is linked to the proprietor and the love they have for their business and customers. It is difficult to have employees treat customers the same way that a business owner would. The best way to do this requires a systematic approach. This starts with who you recruit, how you onboard and train them, and the systems and processes that you document on the way you want things done. Franchising with the right owner/operator using your systems and processes correctly ensures consistency in the customer’s experience.

People

It doesn’t matter what product you sell, you’re in the people business. When a business starts out, it’s difficult for the owner to afford the perfect number and quality of people they need. So, systemising the business and looking to grow requires the recruitment of the right people. Franchising enables the business owner to bring likeminded individuals into the business as business partners/franchisees, who will for the most part deliver a better output than employees. These business owners/franchisees are a far higher calibre individuals than a business owner could afford to recruit for a company operated business.

Scale and Grow

Franchising enables the owner to scale and grow the business much quicker, than if they were to continue operating the business themselves. Starting to document the systems and processes of the business makes the business model stronger and easier to scale and grow.

Capital

Most entrepreneurs are bootstrapping when they start their business and have limited access to capital to fund growth. The funds that can be generated through franchising and franchise fees and ongoing royalties, can provide additional capital to grow and make the business more attractive to banking institutions and investors.

Money

Scaling your business generates significantly more cashflow, albeit profitability typically declines in the early stages of establishing a franchise system. I have worked in four franchise systems with founders who told me they made more money before they decided to scale and grow. So, be ready for that, but it does get easier and better as you see more money flowing into your business.

‘Passactive’

This is a phrase that I have coined. It is the combination of passive + active income = passactive. Franchising generates passive income for the franchisor, but to do so, the franchisor must be active in their operation and development of the business. If you are active, you’ll generate passive income through royalties and product supply.

Time

This is most precious commodity known to mankind. It doesn’t matter who you are, we all have the same amount of time each day to do what needs to be done. Franchising gives the owner the ability to grow quicker, and once the business has been scaled, it should provide more time to enjoy the fruits of their labour. But it needs to be said the emerging franchisor will work ridiculously long hours, until the business gets to a size where the business can recruit the resources it needs for the founder/owner to take a step back.

Exit

Having a business that operates without the founder/owner of the business makes it more attractive for potential purchasers, and easier for the founder to step back or exit.

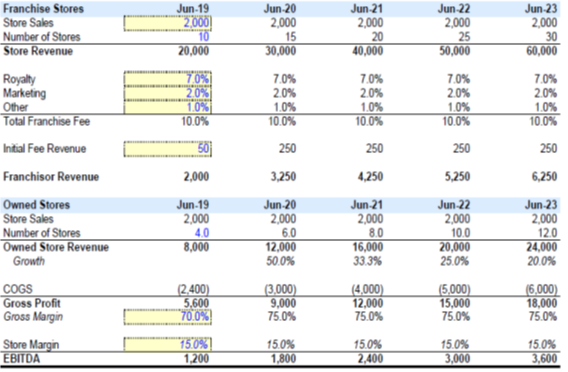

Having profitable company-operated units does significantly increase the value of a business when it comes time to sell, because all the profit is factored into the EBITDA, not just the royalties and franchise fees. But it does cost significantly more to establish the company operations. Having a mix of both operations is a good methodology, and this is best exemplified by Australian burger chain Grill’d. They will open company stores, as they are very profitable, and it enables them to be super selective with franchisees. The table below best illustrates the impact of franchised operations and company operations, and you see the EBITDA and valuation with an increased number of companies operated units.

It is commonly accepted that franchise businesses sell for a greater premium than independent businesses, because of their scalability and systemisation. However, the potential buyers for your business may be limited if they do not understand franchising, because it is a unique way of doing business.

The best examples of this in Australia are brands like Boost Juice, which sold in 2010 valued at $100 million at an EBITDA multiple of over 16 times, and was sold again in 2014 valued at approximately $185 million at an EBITDA multiple over 9 times.

Crust Pizza sold to Retail Food Group for an upfront payment of $41 million at an EBITDA of over 7 times.

Burger chain Grill’d is valued at somewhere between $237 million and $314 million.

Oporto and Red Rooster sold to Archer Capital for a reported $450 million at an EBITDA of over 13 times.

So, you can see from historical sales that established franchise groups can sell for multiples ranging between 7 to 16 times EBITDA, mirroring some highly successful tech businesses. This is significant when compared to the traditional business sales multiples that range from 2 to 5 times.

In the table on the following page, we have provided EBITDA multiples for Australian businesses within the retail and hospitality sector as these two sectors represent over 45% of the total franchise numbers in Australia.

Australian Businesses

The table below illustrates the range of business valuation multiples for all businesses within the retail and hospitality sectors in Australia.

You will have noticed with the examples presented regarding the sale and acquisition of large Australian franchisor groups, that they have typically commanded much higher multiples than the whole industry. The reasons for this are not solely linked to EBITDA and tangible assets, as there are some intangible assets that come into play, including:

- The brand, marketing presence, and the investment made to date.

- The systems and processes that have been developed, better known as the intellectual property.

- Perfecting the model and the lessons learnt from the mistakes that have been made in establishing the franchise business.

- A proven and profitable business model.

- The human resources and expertise within a franchise business.

All the attributes of a franchisor can be achieved by an independent business, so it’s not critical to become a franchisor if the business owner has no desire to venture down that path.

| EBITDA | Retail Low | Retail Mid | Retail High | Hospitality Low | Hospitality Mid | Hospitality High |

| Micro ($0–500K) | 0.58 | 1.92 | 5.62 | 0.76 | 1.66 | 3.97 |

| Small ($500k – $1m) | 0.72 | 1.86 | 4.97 | 0.74 | 1.95 | 4.71 |

| Medium ($1m – $5m) | 0.97 | 2.17 | 4.93 | 0.99 | 2.29 | 4.59 |

| Middle ($5m – $15m) | 1.39 | 2.44 | 4.03 | 2.32 | 2.87 | 3.67 |

“Run your business as if you’re going to sell it. At some point you will sell it, so start planning now”

—Doug Downer

Takeaways

- Having documented systems and processes makes business easier and scalable.

- Every business owner is self-employed, but not every self-employed person is a business owner.

- Business owners make more money and have a better quality of life than the self-employed.

- Franchise businesses and systems sell for a significantly greater multiple than independent businesses, particularly if they have profitable company operations.

Complete our Franchise Readiness Scorecard and get a complimentary whiteboard strategy session!